- March 28, 2024

- finance blogger

How Do I Apply for a Personal Loan?

Personal loans are a versatile financial tool that can help you manage various expenses, from consolidating debt to funding significant purchases. With Venture Finance Solutions, you can enjoy competitive interest rates, flexible loan amounts, and a seamless application process to meet your financial needs. Whether you’re exploring California personal loans for local lending options or […]

- December 16, 2025

- finance blogger

How to Qualify for a Personal Loan Easily

Getting approved for a personal loan can feel confusing, stressful, and sometimes intimidating, especially if you are unsure what lenders really look for. After two decades of writing and advising in the finance industry, I have seen one truth repeat itself again and again. Most loan rejections happen not because people are unqualified, but because […]

- December 11, 2025

- finance blogger

How to Get a Personal Loan With Bad Credit

Trying to get a personal loan with a bad credit score often feels like a dead end. Many borrowers assume that banks will instantly deny their applications or that only expensive lenders will be willing to help. The truth is that you can still qualify even if your credit score is low. Lenders today use […]

- December 3, 2025

- finance blogger

What Is a Personal Loan and How Does It Work

Unexpected expenses can appear at any time and put sudden pressure on your budget. A car repair, a medical bill, or a rising credit card balance can create stress and leave you searching for a simple way to access extra money. In situations like these, many people turn to personal loans because they offer fast […]

- November 26, 2025

- finance blogger

How to Get a Personal Loan: Complete Step-by-Step Guide

Getting a personal loan should feel simple, not stressful. Yet many people get confused by interest rates, paperwork, and lender requirements. The good news? If you know exactly what lenders look for, you can boost your approval chances, secure a lower rate, and avoid common traps that cost borrowers money. In this guide, you’ll learn […]

- November 8, 2025

- finance blogger

What Is a Benefit of Obtaining a Personal Loan?

Life has a way of surprising us with sudden expenses like a medical bill, home repair, or a special family event. In such moments, having access to quick and reliable funds can make all the difference. That’s where a personal loan becomes a practical solution. A personal loan allows you to borrow money without using […]

- October 22, 2025

- finance blogger

Personal Loan vs. Credit Card: Which Is the Smarter Way to Manage Debt?

Let’s face it, when you’re juggling multiple bills or struggling with debt, deciding between taking a personal loan or relying on a credit card can be confusing. You want the cheaper, smarter, and more practical option, one that helps you move forward instead of sinking deeper into debt. With the rising cost of living and […]

- September 8, 2025

- finance blogger

Choosing the Right Personal Loan for You

Life is full of surprises—some exciting and others requiring urgent financial solutions. Whether you need to consolidate debt, renovate your dream home, or cover unexpected medical expenses, selecting the right personal loan can make a significant difference. With numerous options available, including personal loans for 10000 or even flexible personal loans for 10k, finding a […]

- August 25, 2025

- finance blogger

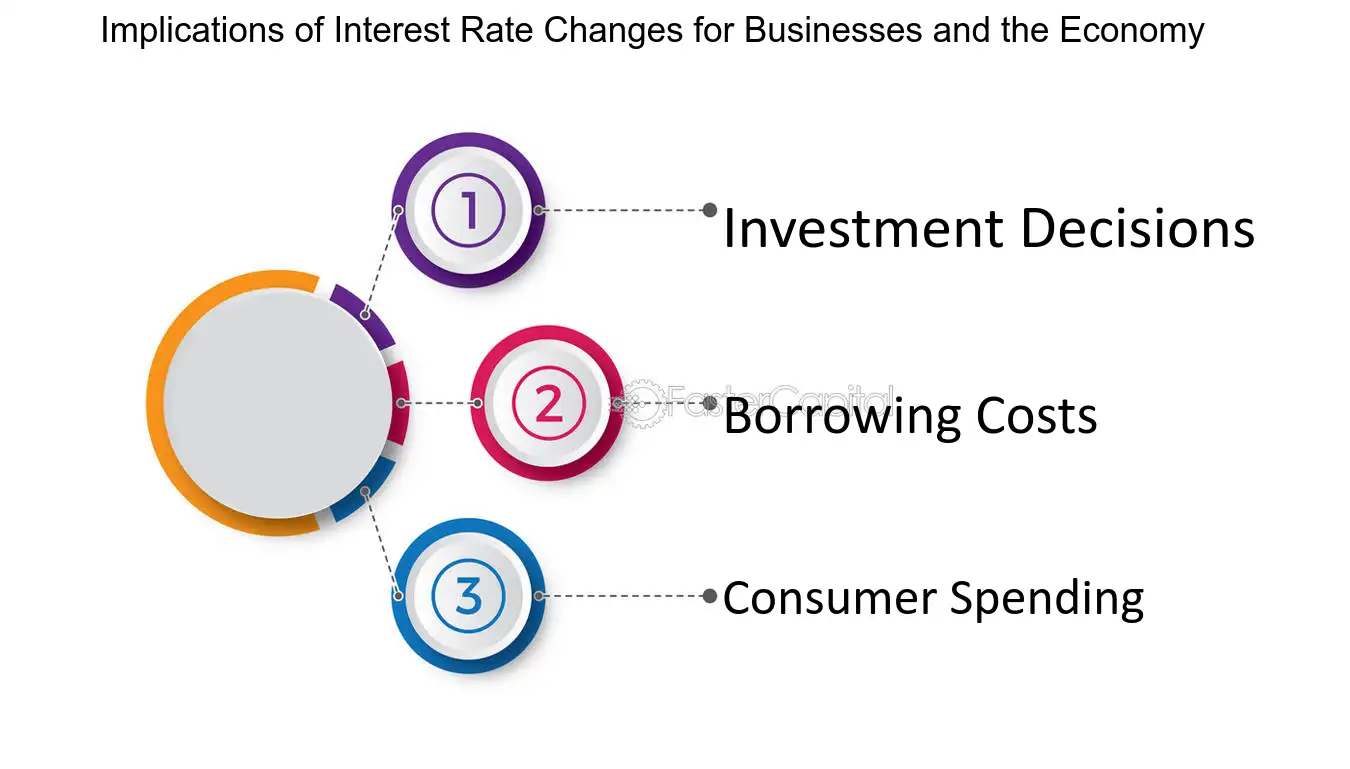

How Economic Shifts Influence Loan Interest Rates

Why do interest rates on loans change? Like the economy overall, these rates are influenced by the dynamic interplay of policy-driven and financial variables. The price of credit, however, is governed by many factors including movements in international markets as well as inflation. Awareness of these variables can give you an edge when applying for a loan […]

- August 18, 2025

- finance blogger

How to Get Your Loan Approved Fast

Despite the seemingly difficult task of receiving loan approval on time, you might expedite it considerably if done correctly. There are different areas to which lenders are likely to turn their attention when approving loans, whether you have money requirements in the form of a home, vehicle, business, or miscellaneous expenses. For urgent funding needs, […]